This year I’ve been very intentional with ensuring my credit score increases and growing my retirement account. I can honestly say, I am proud of myself because just a year ago, this was just a plan on my to-do list and now I’m starting to see the fruits of my labor.

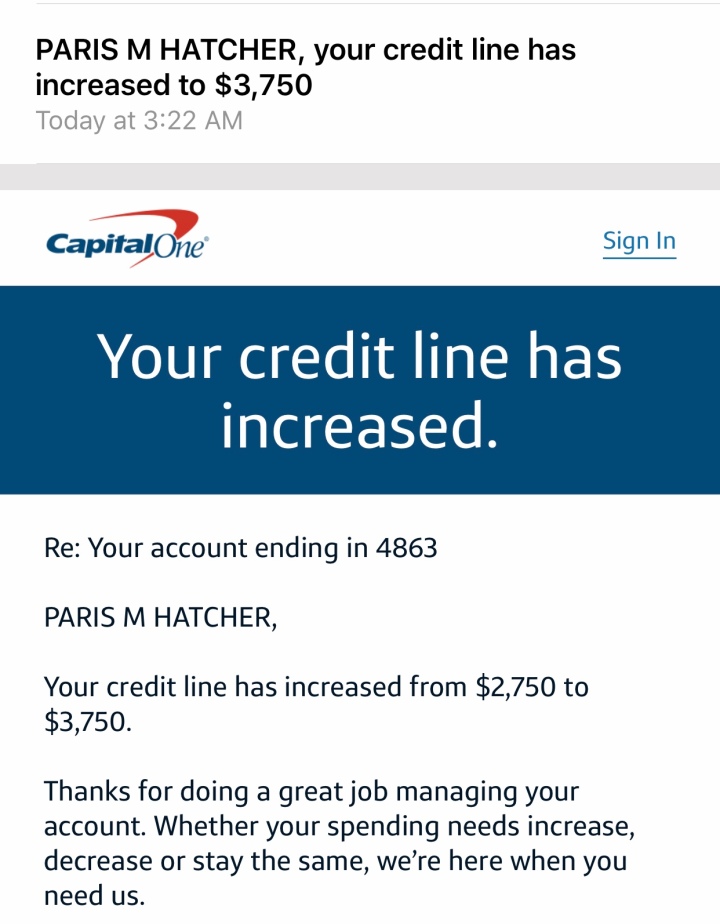

On Monday, I woke up to an email from Capital One stating that my line of credit increased by $1,000 without me ever contacting them and requesting an increase!!!!

If you’re not familiar with a credit line increase and how it works, then I am here to help!

Credit card companies only increase your credit limit as you demonstrate you can handle credit responsibly. That means charging only 30% or less of your total credit limit and making your payments on time each month.

I choose to share my credit line increase as motivational purposes, only. I want you to see from someone who started off at just a $500 credit limit has now risen to $3,750 in just a year. I want you to start setting goals for yourself for the New Year and take steps daily to ensure you’re reaching those goals. I want you to know exactly what I did to increase my credit limit and prove to you that it’s possible for you too if having excellent credit is your goal.

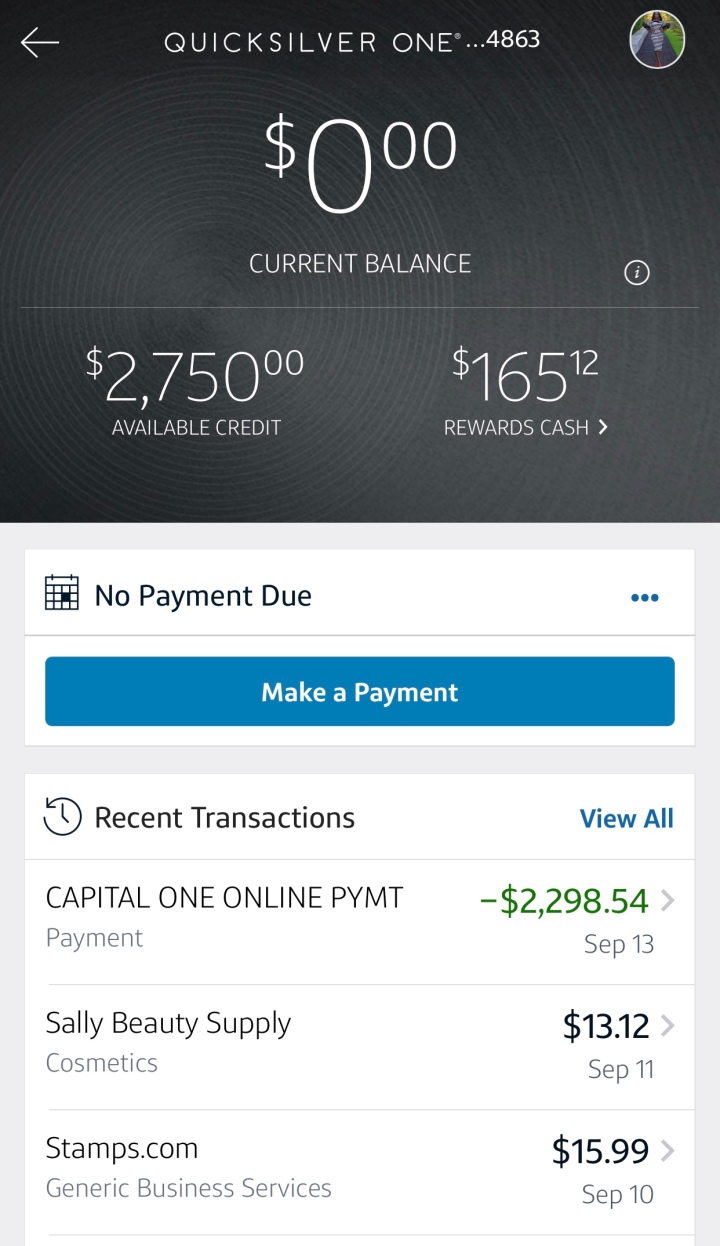

I have the Capital One Quicksilver One Card and when I first applied for the card, the limit started off at $500. To be honest, I was fine with that amount and I was even better when it increased to $750. It showed me that I was on the right track by keeping my balance under 30% and paying it off before the due date. If you’re not familiar with the 5 components of how your credit score is determined, then be sure to check out the post here where each component percentage is broken down for you.

In September I used my card a lot but I did pay off the balance in full before the due date. This card also gives me rewards cash but I haven’t used any because I’m enjoying seeing it grow.

The main thing to remember about credit cards is: It’s important that you don’t use more than 30% of your credit card limit BUT, things happen so if you must, do your best to pay it in full. Never be afraid to use your card because you don’t want to be in debt, ONLY use what you can afford to pay off in full before the due date. Take the limits off of yourself and let’s raise our credit scores together!!!